The subject of transfer pricing (TP) has gained a great deal of momentum globally over the past couple of years. Most of the OECD and G20 countries had implemented TP legislations even before the BEPS initiative, and have issued further regulations following finalisation of the BEPS Action Plan reports. The Gulf Cooperation Council (GCC) countries – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia (KSA) and the United Arab Emirates (UAE) – have not been immune to global TP developments. Additionally, while Kuwait, Oman, Qatar and KSA contain provisions in their respective income tax laws providing for related party transactions to be at arm’s length, TP arrangements were not really being challenged by tax authorities in much detail until recently.

While detailed TP provisions have only recently been issued by KSA and Qatar, GCC-headquartered groups are already filing Country-by-Country (CbC) Reports and preparing Master Files and Local Files in other countries in which they operate, and which have the underlying TP legislation.

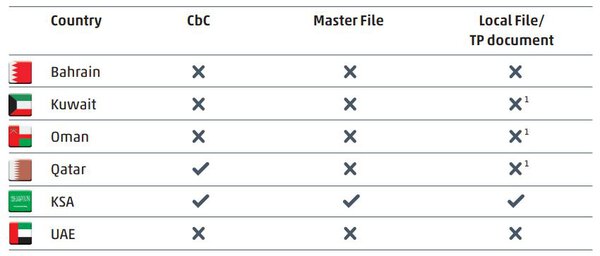

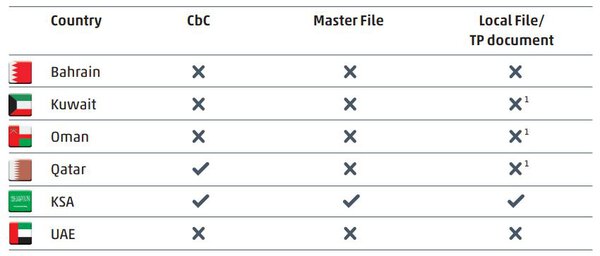

This article contains a summary of the existing TP legislative framework in the GCC countries. The following table summarises the existing TP legislation / compliance requirements in these countries:

1 No specific documentation requirements: only arm’s length provision for related party transactions

As outlined in the table above, Bahrain and UAE do not have any TP legislation at present. This stems from a lack of corporation tax regimes in these countries to form the basis for any TP legislation, warranting payment of appropriate taxes in countries where value generating activities are performed.

The TP principles applied by tax authorities in Kuwait, Oman and Qatar are applied broadly as anti-avoidance measures. Accordingly, during tax audits, where it is determined that the taxable income is understated due to any related party transactions, the tax authorities may request evidence to support the arm’s length nature of such transactions. Increasingly, multinational companies with operations in these countries are preparing local documentation to support and defend TP enquiries during audits, even in the absence of formal requirements.

A summary of KSA’s TP regulations

The KSA TP bylaws are broadly in line with the OECD TP Guidelines and contain the requirements for maintenance of three-tiered TP documentation (from the year ended 31 December 2018 onwards), i.e. Master File, Local File and CbC Report for taxpayers meeting certain thresholds. Some of the key features of the new KSA TP regulations are:

- Broad definition of “controlled transactions”: departure from OECD TP Guidelines and existing KSA income tax law;

- Requirement of filing the Disclosure Form of the Controlled Transactions along with income tax return and certification from a licensed auditor regarding consistent application of the TP policy;

- Not applicable to Zakat payers2 (except for CbC provisions);

KSA has not yet signed the CbC MCAA3 providing for exchange of CbC Reports between countries and is expected to do the same shortly.

CbC provisions in Qatar

Qatar published the CbC requirements in its official gazette on 9 September 2018. Accordingly, Qatar tax resident entities that are members of multinational groups having annual consolidated revenues exceeding QAR 3bn (approximately EUR 700m) in the previous year are required to comply with the CbC Report filing requirements in Qatar for fiscal years commencing on or after 1 January 2017. Qatar signed the CbC MCAA in 2018.

According to a recent circular released by Qatar’s Ministry of Finance, Qatar-resident entities that are not the ultimate parent entity of an MNE group are not required to file notifications or CbC Reports for the years 2017 and 2018. Further clarity and instructions are expected soon.

The future of transfer pricing in the GCC

Five out of six GCC countries (not Kuwait) have joined the BEPS inclusive framework and accordingly, are required to adopt the four minimum BEPS standards4 , one of which relates to TP documentation and CbC reporting. Being a G20 member, KSA was expected to be the first of the GCC countries to endorse the Action 13 report and to introduce formal TP law in respect of documentation requirements. Other countries are also expected to follow suit in due course and CbC provisions are expected to be announced soon.

TP audits are on the rise in the GCC countries, and tax authorities have begun asking questions regarding the TP policies for intra-group transactions; this is also due to the global focus on TP issues. In the absence of local TP legislation, taxpayers and tax authorities in the GCC often refer to the guidance and principles listed in the OECD TP Guidelines.

There have been discussions around potential introduction of a corporation tax framework in the UAE5 in future. Once this happens, we might expect introduction of TP principles embedded in the corporation tax law. The UAE may introduce CbC provisions sooner, as UAE is a BEPS Inclusive Framework member, and has already signed the CbC MCAA providing for exchange of CbC Reports.

In the context of KSA, given that the year ended 31 December 2018 is the first to be covered by the newly issued TP bylaws, one will have to wait to see how the GAZT implements the bylaws in practice. Also, once the CbC Report exchanges begin, it will be interesting to see how the tax authorities in the GCC use the information documented in these reports to make transfer pricing risk assessments.

Sign of shifting sands in the GCC!

2 Entities owned by GCC nationals

3 Multilateral Competent Authority Agreement on the exchange of Country-by-Country Reports

4 he four minimum standards are Countering harmful tax practices (Action 5), Countering tax treaty abuse (Action 6), Transfer pricing documentation and CbC reporting (Action 13), and Improving dispute resolution mechanisms (Action 14)

5 Although each Emirate has his own corporate tax decree, taxes are not practically imposed on entities other than specified oil and gas sector entities and branches of foreign banks