Customs, Energy & Consumption Tax

Customs duties and consumption taxes are the oldest form of taxation. Energy taxes are also very important as they tax the supply and consumption of electricity, natural gas and coal.

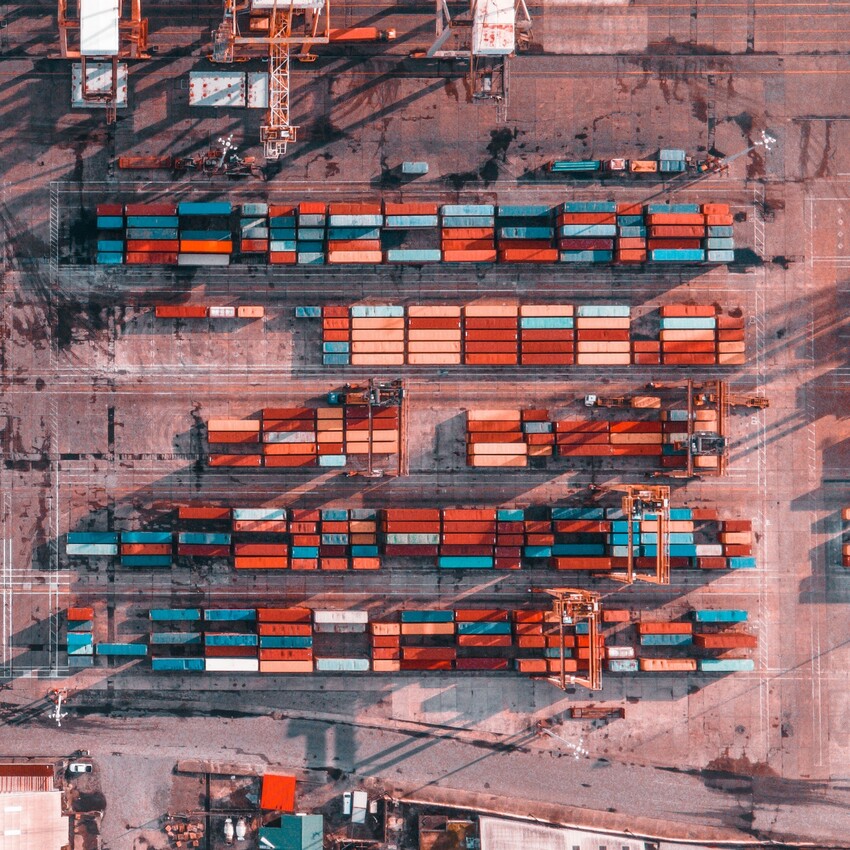

In a globalised world, cross-border product development and the international sale of goods are key economic drivers. Customs and international trade law can present compliance hurdles for global companies. Laws and regulations must therefore be addressed with appropriate awareness. This is the only way to overcome the challenges of global trade and find the best possible operative and tax solutions for companies.

Our WTS experts assist clients with all matters relating to customs and international trade law, drawing on our extensive professional expertise and long-term practical experience. We prepare expert reports and tailored information on customs issues for our clients. This includes customs classifications, support in obtaining binding customs information and determining customs values. We advise on questions relating to origin of goods and preferences. We also support clients with respect to anti-dumping measures, as well as with questions relating to customs and international trade law exports. Advising on current import/export restrictions as well as on individual export control issues complete the range of services offered by WTS Austria.

Our WTS experts also advise clients on the following topics:

- Application for customs exemptions (tariff suspension or tariff quota)

- Analysis to reduce customs charges through the use of preferences

- Review of import tax notices

- Assistance in the preparation of remission and/or reimbursement requests

At WTS we prepare our clients for external audits. We also represent them vis-à-vis the financial and customs authorities and assist with customs inspections. We also analyse audit reports and use them to derive policy recommendations.

Constant changes in the substantive and procedural customs, consumption and energy taxation rules inevitably lead to legal uncertainty. By constantly monitoring and evaluating the latest developments and working with our colleagues from WTS Global, we guarantee you superior knowledge and create the basis for high quality consulting to solve your customs, consumption and energy taxation issues.

Consumption taxes

Another area of expertise at WTS Austria is consumption tax. Consumption tax is usually incurred when consuming or using excisable goods. In the European Union, consumption tax on mineral oils, alcohol and alcoholic beverages as well as tobacco products are generally regulated in a uniform manner. The General Excise Duty Directive (System Directive 2008/118 / EC) defines the principles of the intra-Community consumption tax system. The system directive is supplemented by the structure directive, which defines the taxable items in more detail. These EU law requirements were implemented in the following laws:

- Alcohol Tax Act (AlkStG) for alcohol and goods containing alcohol

- Beer Tax Act (BierStG) for beer

- Mineral Oil Tax Act (MinStG) for mineral oil, fuels and heating fuels

- Sparkling Wine Tax Act (SchwStG) for sparkling wine, wine and intermediate products

- Tobacco Tax Act (TabStG) for tobacco products

The assessment bases and tax rates are regulated on a casuistic basis for consumption taxes, but this usually relates to so-called volume taxes. Similar to VAT law, the levying of consumption tax is based on the country of destination principle. Goods are subject to taxation only at the place of consumption (where they are placed on the market). The procedure for the taxation of consumption taxes is regulated in a very formal manner and is very similar to customs legislation.

There are two types of procedure for intra-community transport: tax suspension and tax-free transport. The "using companies" must also be considered; these are companies that can obtain goods untaxed and that are entitled to use them for a specific purpose tax-free.

Energy taxes

Energy taxes include electricity tax, energy tax rebate, natural gas tax and coal tax. One of the objectives of introducing energy taxes was the unspecified ecologising of the tax system. In principle, taxation takes place on delivery to the final consumer or consumer of the energy sources. When it comes to energy taxes, the amount of tax depends on the delivered or consumed quantity of the taxable goods.

Contact us today

Do you have any questions about our services or WTS? Please let us know. Please fill in our short contact form. We will get in touch with you as soon as possible.