18.06.2019

Australia introduces new Transfer Pricing Guideline for “inbound distributors”

One particular area of focus is the transfer pricing arrangements involving inbound Australian distributors

The Australian Tax Office (ATO) is aggressively challenging the transfer pricing arrangements of foreign-owned multinationals operating in Australia. This ATO focus is attracting significant public and media attention, as the cross-border dealings of multinationals and the role of their “Big 4” advisors (who provide both legal and non-audit services) have become front-page news in Australia.

One particular area of focus is the transfer pricing arrangements involving inbound Australian distributors as set out in a draft ATO Guideline: Transfer pricing issues related to inbound distribution arrangements (PCG 2019/1).

What is an inbound distributor?

An inbound distributor is an Australian business that predominately distributes goods purchased from related foreign entities for resale, primarily to business-to-business customers, not end consumers.

ATO approach – 3 risk zones

The ATO has identified 3 risk zones: high, medium and low. If inbound distribution arrangements are identified as high risk, the ATO has suggested they will engage in activities such as monitoring the transfer pricing arrangement or commencing a review on an entity.

How does the ATO assess inbound distribution arrangements?

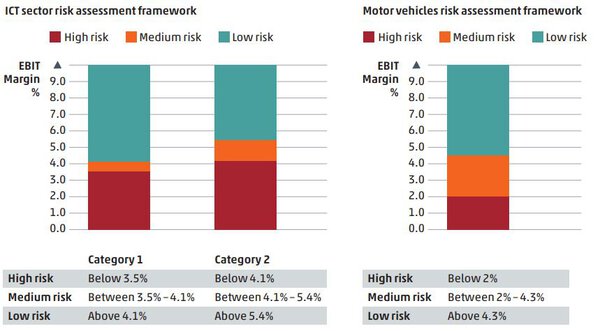

The ATO compares the profit achieved by the arrangement against profit markers identified by the ATO for specific industries. The measurement the ATO will use to analyse the profit achieved by an inbound distributor is Earnings before Interest and Tax (EBIT) relative to sales. The ATO will assess these profit markers on an industry basis as summarised below.

- General distributors: Entities from a wide range of sectors would fit into this category.

- Life science: Entities engaged in the discovery, development, production, sales and marketing of medicine, separated into three categories:

Category one: Distribution of life science products, including detailing, marketing, logistics and warehousing.

Category two: Activities specified in category one, and activities associated with regulatory approval, market access or government reimbursement.

Category three: Activities specified in categories one and two, and specialised technical services such as training in surgical procedures involving medical devices. - Information and communication technology (ICT): Computer hardware and software products and any services related to technology, separated into two categories:

Category one: Entity engaged in the distribution of ICT products.

Category two: Entity engaged in activities specified in category one, and any other activities such as complex sales processes, direct selling which supports the main distribution activities, and large customer relationship management. - Motor vehicles: Any activities associated with motor vehicles such as marketing, sales, after sales, procurement, administration, insurance, transportation, warehousing and inventory management.

What should companies do?

ATO Practical Compliance Guidelines provide law administration guidance regarding the ATO’s method of assessing tax compliance risk, and how it is likely to deploy its audit resources. Multinationals should review their Australian distribution arrangements. Where they fall into the “High Risk” zone, companies should consider why, and prepare for ATO compliance action. This may include engaging proactively with the ATO to best manage the multinational’s risk profile.

Contact

Craig Silverwood – MinterEllison

Email: craig.silverwood@ minterellison.com

Sian Jackson-Findlay - MinterEllison

Kip Harding – Red Consulting

Article published in TP Newsletter #1/2019

Transfer Pricing Newsletter: Update on the recent news and cases

View publication

Newsletter Transfer Pricing

With this newsletter, we inform multinational companies on country-specific and international legislative documents and regulations.

Get in contact

If you have any questions about WTS Global or our global services, please get in touch.

We will respond to you as soon as possible.