13.08.2020

DAC6 Advisory: UK Mandatory Disclosure Regime

FTI Consulting European Tax Advisory

From 1 January 2021 companies and advisors will have to make reports to HMRC in accordance with the International Tax Enforcement (Disclosable Arrangements) Regulations 2020 which implements EU Directive 2018/822, more commonly known as DAC6. This obligation covers cross-border arrangements that began on or after 25 June 2018.

Our member firm FTI Consulting is able to provide advisory services to organisations who are dealing with their DAC6 obligations in-house, covering impact analysis, process design, training, support and HMRC filing.

View the the FTI Service Sheet related to DAC6 here.

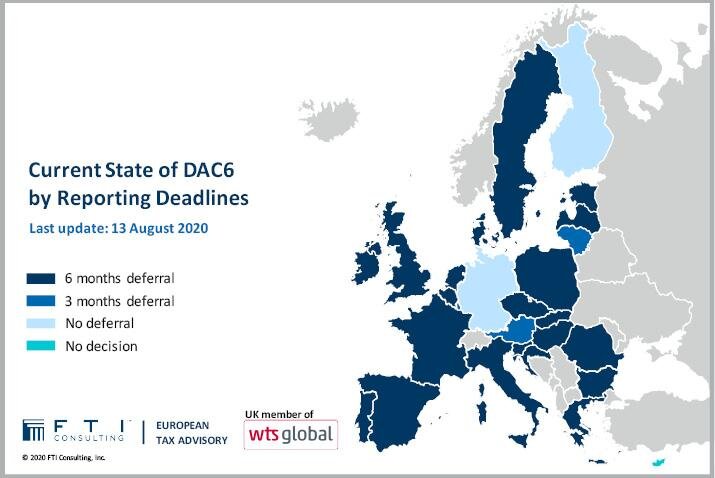

Current State of DAC6 by Reporting Deadlines

DAC6 Advisory:

UK Mandatory Disclosure Regime

PDF

UK Mandatory Disclosure Regime

Get in contact

If you have any questions about WTS Global or our global services, please get in touch.

We will respond to you as soon as possible.