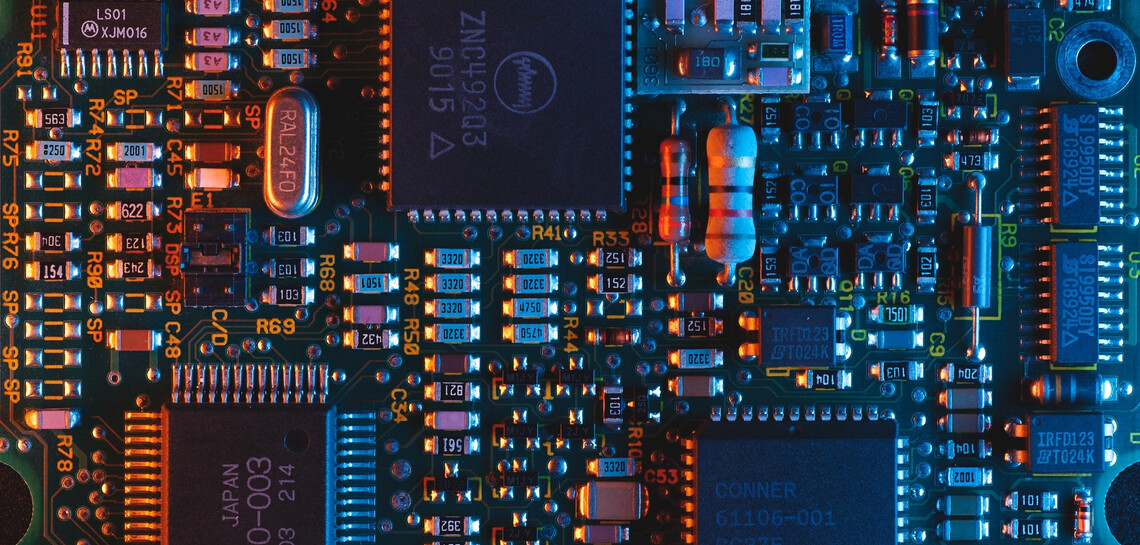

Datacenters play a crucial role in the ever-growing digital world. Just like the digital world, datacenters have also experienced a substantial evolution, starting from the ENIAC1 system in the 1940s through to the current-day business models that are shifting from the ownership of infrastructure, hardware and software to a subscription and pay-per-use model. While the daily online environment in which we all operate continues to develop, such as with the rise of Edge Computing2 and solutions like Bare Metal servers, a large part of today’s online activities take place in the ‘cloud’. One of the key requirements for such a cloud is the use of datacenters. A datacenter is a physical building that offers protection for the required hardware that guarantees smooth-running servers.

It is this physical building that has recently triggered the tax authorities to take the position that, for VAT purposes, services supplied by a datacenter should qualify as services related to real property. As a result, under the EU rules for the place of supply of a service, such services would be taxable in the EU jurisdiction where the particular datacenter is physically located. Taking such a position causes various adverse consequences for the datacenter as well as its customers.

Following this ECJ ruling, the French Court of Appeal of Versailles had to judge on the VAT qualification of so-called interconnection services supplied by datacenters. These interconnection services differ from the more “traditional” colocation services, as they establish a direct connection that align a certain logic between the various users within a datacenter, whilst colocation services, in principle, facilitate users to connect their servers with the World Wide Web. Given the differences between the nature of these types of services, the case before the French Court of Appeal was of immediate importance for datacenters.

Just before the end of 2020, the network firm of WTS Global, Atlas Tax Lawyers won an appeal on behalf of a US-based global datacenter operator, (“the company”) against a VAT assessment by the French Tax Authorities (“FTA”).

The FTA had taken the view that these interconnection services qualified, for VAT purposes, as services related to real property and were thus taxable in France, even if the B2B customer was not based in France.

The company operates several datacenters in France and provides a range of services to its customers, including interconnection services (i.e. establishing a physical connection by means of physical cables between its customers’ servers). These so-called interconnection services also included hosting services, such as installation work, the provision of rack space, electric power supply, air conditioning, etc.

According to the company, the services provided to its customers who are not established in France should fall under the B2B place of supply rules and would thus be taxable at the customer. As a consequence, services charged to non-French established customers had to be invoiced without French VAT, under the Reverse Charge regime.

However, the FTA argued that these interconnection services had to be charged with French VAT at all times, since they were related to real property (i.e. the datacenters) located in France.

In its assessment, the French Court of Appeal quoted the ECJ and recollected that hosting services in a datacenter (in the framework of which the services provider makes rack space available to its customers (i.e. colocation), installs their servers, and provides them with ancillary goods and services, such as electricity and various services intended to ensure the use of these servers under optimal conditions), for VAT purposes, does not constitute services relating to real property. As such, customers do not benefit from a right of exclusive use of the part of the property in which the racks are installed (ECJ, July 2nd, 2020,. C-215/19,( A Oy)).

In the underlying case, over which the French Court of Appeal had to rule, it decided that, for VAT purposes, the services provided by the company e.g. the installation work, server storage, electric power supply, air conditioning, and, most importantly, the interconnection services, qualify as a single supply.

Furthermore, the Court of Appeal ruled that it appeared from the underlying contracts that the customers also were not obtaining any exclusive right to use an expressly-designated portion of the datacenter buildings. Rather, according to the Court of Appeal, the company was merely providing a secure space for each client to install its equipment and benefit from the company's interconnection services.

As a result, the services provided by the company could not be considered as being related to real property located in France. For the full judgment, please go to CAA Versailles, December 8th, 2020, aff. 19VE00526.

WTS Global

In addition to the ECJ’s A Oy case, we find that the French Court of Appeal’s ruling is a welcome addition for the datacenter industry. Both cases show that, although datacenters require a physical location to supply their services in an optimal way, this physical location is merely ancillary to such a datacenter’s key services.

In our view, the ECJ, as well as the French Court of Appeal, have taken the correct approach in these cases. Not only do the outcomes of these cases reflect the economic reality of the underlying services (i.e. the main purpose for customers in acquiring such services is to establish, improve or upgrade their connection speed), they are also aligned with the approach on the EU VAT rules relating to services related to real property as set out in the Explanatory Notes of 2017.

In this regard, we point out that a number of EU Member States in the past have already taken a position, i.e. by means of a ruling or a specific policy, that is aligned with this approach by treating a datacenter’s services as services taxable under the general VAT rules for the place of supply, rather than treating these services as services related to real property.

However, some EU Member States, while only a few in number, still treat these services as services related to real property. Given the ECJ case, as well as the French Court of Appeal ruling, we find that datacenter operators, or their customers, have very good arguments to take the position that these services should be taxed under the general VAT rules for the place of supply.

Sweden

One of the EU Member States that has recently changed its legal stance relating to the VAT qualification of services supplied by datacenters is Sweden. In the past, the Swedish Courts had ruled that such services qualified as services related to real property (RÅ 2008 ref. 48 en HFD 2016 ref.75).

However, in a recent court ruling, the Swedish Administrative Supreme Court changed the Swedish legal position by qualifying colocation services as services taxable under the general VAT rules for the place of supply.

We recommend that datacenters operating in Sweden, as well as the customers of such datacenters, review their financial position in order to align the VAT logic with this recent ruling.

Contact Persons:

| Atlas Tax Lawyers |

|

|

| |

|

|

|

Johan Visser

jv@atlas.tax

+31 202 376 299

|

Ivo Kuipers

ik@atlas.tax

+31 2053 54562 |

Anna Bonder

abo@atlas.tax

+31 202 376 232

|

| |

|

|

| |

|

|

| Svalner |

|

|

| |

|

|

|

Linus Lindström

linus.lindstrom@svalner.se

+46 70 964 13 54

|

Emil Virhammer

emil.virhammar@svalner.se

+46 70 220 89 02 |

|

[2] The word ‘edge’ in this context means literal geographic distribution. Edge computing is computing that is done at or near the source of the data, instead of relying on the cloud at one of a dozen datacenters to do all the work. It does not mean the cloud will disappear; it means the cloud is coming to you.