The Philippines kept to its commitment to the international community when it successfully legislated the management and regulation of trading strategic goods or technology that could potentially be used in the proliferation and manufacturing of harmful devices and prohibited weapons of mass destruction (WMD).

As early as in 2009, there were attempts to pass a trade and security legislation in the Philippines. However, it was not until 2015 that the country’s Sixteenth Congress, after the failed bids of the two previous congresses, finally succeeded in enacting Republic Act (RA) No. 10697, otherwise known as the “Strategic Trade Management Act” (STMA). It seeks to prevent the proliferation of weapons of mass destruction by managing the trading of strategic goods. This is in line with the Philippines’ binding commitment to U.N Security Council Resolution 1540, which it co-sponsored and was adopted unanimously by UN Member States in 2004. It imposes upon States to take and enforce measures to establish domestic controls preventing the proliferation of nuclear, chemical or biological weapons and their means of delivery. As per our Constitution, the Philippines adopts and pursues a policy of freedom from nuclear weapons in its territory. It thus seeks to prevent the Philippines from becoming a potential hub for illicit trafficking for proliferators.

But what are these “strategic goods” subject to trade management and regulation in the Philippine context?

They are products that, for security reasons or due to international agreements, are considered to be of military importance, therefore their export is either prohibited or subject to specific conditions. Under this law, there is a published National Strategic Goods List (NSGL), specifically describing the strategic goods to be subject to authorisation. It comprises:

(a) Military Goods (Appendix 1);

(b) Dual-Use Goods (Appendix 2); and

(c) Nationally Controlled Goods (Appendix 3).

“Military goods” are items or technology developed for military-end use, whilst “nationally controlled goods” are those placed under control for reasons of national security, foreign policy, anti-terrorism and public safety. The complications may relate more to “dual-use goods”, referring to items, software and technology that can be used for both civil and military end-use or in connection with the development, production, storage or dissemination of WMD or their means of delivery. Examples of these are aluminium alloy, machine tools, telecom systems, equipment, etc., which are ordinarily manufactured by companies for export or local use.

In addition to the above lists, Section 11 of the law provides for end-use controls to be imposed up on strategic goods NOT in the NSGL, i.e. unlisted goods or service, but where individual licence may still be required as they may be used in the acquisition, development or production of WMDs, amongst others, or their means of delivery. This is the “catch-all” provision of the law.

Under the STMA, the National Security Council – Strategic Trade Management Committee (NSC- STMCom) is the central authority on all matters relating to strategic trade management. The Executive Secretary serves as the Chairperson, whilst the Secretary of the Department of Trade and Industry (DTI) is the Deputy Chairperson with the Secretaries from the different departments (e.g. Foreign Affairs, Justice, National Defence, Finance, etc.) as members, plus the National Security Adviser. On the other hand, the Strategic Trade Management Office (STMO), an attached bureau of the DTI and headed by a Director, serves as the executive and technical agency to establish the management systems for the trade in strategic goods.

RA 10697 applies to and requires the authorisation, by the STMO, of any individuals or legal entities operating within the Philippines or Filipinos, wherever located, providing these services or activities:

- export, import, transit or trans-shipment;

- provision of related services (i.e. brokering, financing and transporting); and

- re-export or reassignment of goods.

Based on the DTI’s Administrative Order 19-07, the STMO adopts a phased implementation of the above activities. It started with Registration, under Phase 1, in the latter part of 2019 and now with Export under Phase 2, up to Phase 6 for Importations. This is to give the stakeholders ample time to fully comply.

As of 1 July 2020, the STMO began the authorisation for the export of strategic goods. Prior to applying for such authorisation, all persons engaged in the export of such strategic goods are required to register first with the STMO, as of 14 October 2019 (i.e. entering, into the STMO Register, those covered entities). Note that, aside from actual shipment of strategic goods out of the Philippines, regulated export activities also include the transmission of software and technology.

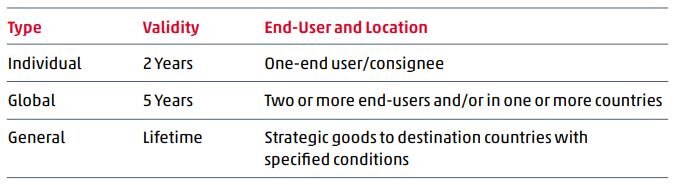

There are three (3) types of export authorisation or licences to be secured prior to exporting:

Amongst those exempted from said authorisation, those made by the government for the use of the military or police forces or, if connected, with law enforcement activities would be included.

The Philippines has already taken the first step in having the legal framework for trade management to protect the nation’s security, as well as the integrity of the international supply chain. This becomes more significant as Asia, including the Philippines, expands its role in the global economy, particularly in the manufacturing and service sectors. For this, the Philippines needs an effective management regime of these strategic goods. Aside from a comprehensive legislative framework and rules, the other critical factors for success would be an effective enforcement and implementation, as well as local and global cooperation and coordination.

The law and the related rules should address the clear and tight controls on all trade activities by covered as well as unauthorised persons, but balancing it against excessive interference and complicating one’s business transactions. During the registration phase, a solid database for companies and goods should be created for the effective monitoring and smooth processing of current and future transactions. The law, rules and policies should provide the implementing agencies involved (e.g. trade, customs, military, police authorities, etc.) with a clear mandate and authority, technical training and resources for effective and strict enforcement. Lastly, raising the awareness of and educating the stakeholders involved, both the business and industry sectors that would be covered (e.g. exporters and manufacturers or those registered under our investment laws, such as the Philippine Economic Zone Authority) and the implementing agencies, as well as reaching out to the international community for proper coordination and learning from their best practices that the Philippines could adopt, are all valuable and critical factors to achieve the objectives of this very important trade and security legislation. Its success could have far-reaching effects, not only within the territorial jurisdiction of the Philippines, but also with impacts on the stability and security of the whole ASEAN region and beyond.

Read the WTS Global Customs Newsletter here