Asia has been actively entering into Free Trade Agreements (“FTAs”) since the 1980s. This trend shows no sign of abatement.

Since the beginning of 2022, most Asia-Pacific (“APAC”) economies are starting to show signs of post-pandemic economic recovery. The Regional Comprehensive Economic Partnership (“RCEP”), which came into effect on 1 January 2022, paves the way for more Free Trade Agreements (“FTAs”) to be signed across the APAC region.

For businesses, more FTAs in the APAC is beneficial as it enables savings in supply chain costs and heightened transparency in trading lanes. However, more FTAs also mean new operational challenges for companies, especially as demands on supply chains become more complex.

This commentary will address three main points:

- First, we will review the new FTAs that have recently been signed, upgrades in existing FTAs as well as ongoing negotiations. We will comment on the trend towards plurilateral FTAs. We will also address the EU’s engagement in Asia and whether the EU-Singapore and EU-Vietnam FTAs could potentially be a harbinger of further FTAs between the EU and countries in Asia.

- Second, we will explore how businesses can benefit from the FTAs. While the use of the tariff concessions continues to be the top use of FTAs, more sophisticated companies are now looking beyond tariff concessions. Instead, they are looking into trade facilitation, the removal of non-tariff barriers and the mutual recognition of testing standards. We will also comment on how businesses can utilise self-certification and Mutual Recognition Agreements to manage the risks involved to ensure that companies maximise benefits.

- Third, we will discuss audit trends and the role of technology. We will touch on the rise of origin verification audits. With the sheer volume of data and complexities involved when dealing with origin verification audits, we will also discuss the role of technology in trade operations within companies.

1. Free Trade Agreements trends across Asia-Pacific

According to the United Nations Economic and Social Commission for Asia and the Pacific (“ESCAP”), there were 15 Preferential Trade Agreements (“PTAs”) signed during 2020-2021. Due to Covid-19, the progress of trade negotiations slowed globally. Many countries shifted their focus onto health emergencies and economic contractions.1 Hence, the number of new agreements signed decreased annually from 13 to 11 agreements in 2019 and 2020, and to only 4 new agreements in 2021.

Nevertheless, 2021 was significant in advancing Asia Pacific’s role in negotiating global trade agreements as seen from the following. First, RCEP was finalised and came into force on 1 January 2022. Second, China submitted its accession proposal for membership to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (“CPTPP”) in September 2021, highlighting China’s eagerness to participate in global trade.

A trend towards more bilateral FTAs compared to plurilateral FTAs

Presently, 78% of FTAs signed by Asia-Pacific economies are bilateral, which starkly contrasts with plurilateral FTAs, which only account for 10% of all FTAs.Most of the countries who are part of the bilateral and plurilateral agreements are among common member countries.

That said, RCEP and CPTPP demonstrate the increasing willingness by Asian economies to enter into large, multi-party FTAs. The CPTPP also shows that plurilateral FTAs often enable the deepening of trade relationships across different regions.

Plurilateral FTAs have the benefit of creating a common set of preferential trade rules that cover a large number of countries. This development is positive and could significantly reduce operational and supply chain complexities for businesses.

However, it is important that these plurilateral FTAs continue to have an open architecture that allows for future membership by non-members and does not create closed trading blocs.

A trend towards more comprehensive Preferential Trade Agreements – heightened regulation on domestic policies relating to digital and environmental provisions

Several existing PTAs have been upgraded to become more comprehensive. Eight PTAs across the Asia Pacific region were upgraded after being active for 10 years or more. For example, the e-commerce chapter in the Australia-Singapore FTA added a provision on cross-border data flows. In addition, there has been a general trend for more PTAs to include environmental provisions. According to ESCAP (2021), 85% of PTAs signed in the region after 2005 contained at least one climate-related provision.

Digital Economic Partnership Agreements

On the digital front, digital trade represents the next frontier in economic development in APAC and is a potential engine for significant growth for Southeast Asian countries.

Leading the region on this front, Singapore has signed multiple Digital Economy Partnership Agreements (“DEPA”) with Chile, Australia, New Zealand and most recently, South Korea. Most recently, China has expressed interest in joining Singapore’s DEPA with New Zealand. It is expected that countries in APAC will follow suit to pursue cooperation on digital issues.

EU engagement and the focus in Asia

Noticeably, the EU has increased its trade and economic engagements with the APAC market. In 2021, bilateral exchanges in goods between the EU and Association of Southeast Asian Nations (“ASEAN”) amounted to approximately €200 billion, and the EU remains ASEAN’s largest investor. This presents a good opportunity for EU businesses to expand into key APAC markets to capitalise on their resilient growth.

Since signing the EU-Singapore FTA in 2019 and the EU-Vietnam FTA in 2020, Thailand and the EU have resumed negotiations on the EU-Thailand FTA. The EU also resumed negotiations with Indonesia in November 2021. An EU FTA with ASEAN as a whole is less likely at this point given the issues with Myanmar but these all suggest that the EU is keen to increase its trade engagement with countries in ASEAN and APAC.

2.How businesses can benefit from FTAs

Tariff Preferences and Rules of Origin

FTAs eliminate customs duties for substantially all trade between Member States. Tariff preferences are the most commonly used FTA benefits by businesses.

FTAs have Rules of Origin (“ROO”) that determine whether goods originate from one FTA partner State and qualify for preferential tariffs when imported into the market of another FTA partner State.

However, as ROOs are not unified between different FTAs, businesses need to grapple with increasingly complex and overlapping ROOs. This makes it difficult for businesses to comply with the requirements to enjoy reduced tariff rates.

Unfortunately, despite RCEP, the ROO in Asia-Pacific will not be subsumed into a single unified rule. The RCEP ROO chapter lists minimal operations and processes and is insufficient to confer originating status on goods using non-originating materials. This means that companies must continue to use FTAs on a per country basis, which puts more strain on their internal processes as the number of FTAs and models they must handle continue to increase.

For businesses that intend to rely on preferential tariffs as a cost saving mechanism, the different criteria of substantial transformation under each ROO may result in onerous compliance requirements.

The demands of modern complex supply chains (e.g. regional hubs, just-in-time production, vendor managed inventory, global or regional manufacturing locations, demand to make procurement changes, etc.) also compound the difficulties faced by companies seeking to apply the appropriate ROOs to qualify for duty preferences in a fully compliant manner. It is often difficult to ascertain where the finished goods are destined for and hence which ROO needs to be complied with until the goods have been manufactured and are in storage awaiting shipment.

Self-certification – panacea for dealing with complex ROOs?

The trend towards self-certification has been more prominently featured in FTAs and PTAs lately. In 2020, the ASEAN-Wide Self-Certification (“AWSC”) Scheme was put into effect. The AWSC enabled a single unified self-certification scheme to be adopted across all 10 ASEAN Member States.

This simplifies customs procedures and allows participating companies to claim tariff privileges. For businesses, this means that once they have obtained approval as a certified exporter, then they can claim preferential tariff rates. The implementation of self-certification procedures aims to simplify customs procedures while strengthening supply chain connectivity despite disruptions caused by the pandemic.

The question still stands – should companies embrace self-certification? Some arguments for self-certification include the following:

- to reduce the administrative costs, transaction time and administrative costs for businesses to obtain a preferential certificate of origin;

- to enable businesses to better utilise preferential tariff rates offered under an FTA;

- to improve the origin knowledge and origin skills of manufacturers and traders; and

- to increase importers’ responsibilities.

However, businesses continue to face difficulties because of procedural nuances that continue to change at a rapid pace, making it tough for companies to continually keep track of new developments. Businesses may also lack experience in self-certification or have difficulty in securing a self-certificate of origin from a big supplier – in resisting or refusing larger clients’ origin requests.

Although this article is primarily focused on tariff preferences, we also highlight some of the other benefits that can (and should) be used by businesses in the remaining part of this section.

Reduction of Non-Tariff Measures

Many modern FTAs being signed in APAC, both intra-regionally and inter-regionally, have provisions aimed at reducing Non-Tariff Measures (“NTMs”).

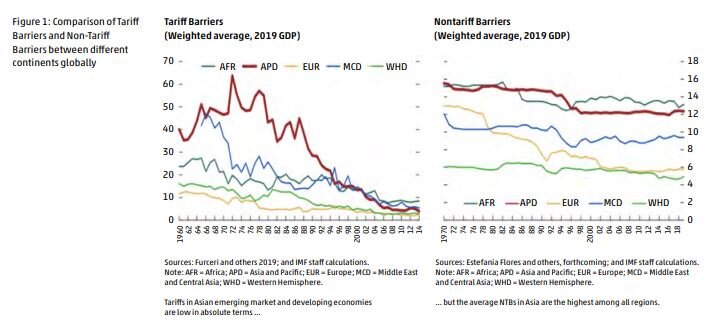

Unlike tariffs, NTMs remain high. The average NTM for emerging markets and developing economies in Asia is the highest across all global regions. According to the official UNCTAD database, approximately 58% of trade volume in the Asia-Pacific is covered by non-tariff measures, and each product (at HS 6-digit level) faces on average 2.5 non-tariff measures. (see Figure 1 below)

This growth in the number of NTMs is a response to general consumer demands for better health and environmental standards; as incomes have risen in developing economies it is natural that regulatory standards have tightened.

Businesses can rely on Mutual Recognition Agreements

Businesses can overcome procedural obstacles by relying on Mutual Recognition Agreements (“MRAs”) to reduce the multiple conformity assessment that products, systems, processes and materials may need to undergo, especially when they are traded across borders.

MRAs provide for mutual recognised standards of testing and equipment procedures undertaken by accredited bodies when accessing technical regulations of the equipment. For example, it was estimated that MRAs would save 5% of the cost of new product placement, reduce by six months the placement of new products on markets, and reduce marketing costs for new products by up to 30%.

In addition to easing the barriers to trade in goods, MRAs also support the liberalisation of trade in services. Businesses can employ MRAs to facilitate the mobility of professionals and skilled labour with partner countries. In addition, businesses can make use of the investment protection provisions that spur investments between MRA partner countries to facilitate growth.

3. Audit Trends and the Role of Technology

Due to the Covid-19 pandemic, most governments have experienced a windfall loss in revenue. In APAC, many governments are strategising about mechanisms to raise much needed national fund injections to propel their individual economies to thrive in a post-pandemic landscape.

Post-clearance customs audit

Businesses should take note that to make up for the revenue shortfall, governments would most probably increase post-clearance audits. This trend has already been proved true for some APAC countries. In May 2021, Thailand’s Customs Department was reported to carry out stricter post-clearance audits where importers were challenged on complex issues.

In addition to conventional issues such as tariff classification, origin of goods, and import and export requirements, the Thai Government went further to access customs valuations and the utilisation of customs and trade privileges.Similarly, in 2021, the Indonesian Directorate General of Customs and Excise also stepped up efforts to perform comprehensive audit inspections to increase the collection of import duties, import taxes, and excise.

Therefore, importers must meticulously check the transaction value declared to the Customs Department, as well as the transfer pricing measure, to avoid a challenge or dispute concerning customs valuation – the risk of which has increased significantly at this time.

Origin verification audits

Although customs audits in Asia have traditionally been focused on classification and valuation issues, there is an increasing trend towards origin verification audits. Origin verification audits have historically been difficult for several reasons:

- Certificates of Origin were typically issued by government authorities in the country of export that was responsible for ensuring compliance with the relevant ROOs;

- whilst importers were responsible for ensuring that they made accurate declarations of imports, including whether they qualified for FTA preferences, importers typically would be highly reliant on information provided by the exporters overseas; and

- it was difficult for a customs authority to audit records of exporters overseas and hence it was difficult to obtain sufficient proof in an audit of non-compliance with ROOs.

That said, FTAs do provide for mechanisms for origin audits – namely direct and indirect verifications. For direct verifications, the importing country’s customs authority directly investigates the exporters of its contracting partner. For indirect verifications, the importing country’s customs authority makes enquiries to the exporting country’s customs authority for verification.

We note that customs authorities in Asia have resorted to indirect as well as increasingly direct verifications to audit origin issues. For instance, in July 2021, it was reported that Korea’s scope of quantitative analysis expanded, and more aggressive direction verification inspection methods of direct verification were applied. This resulted in an increase in the number of origin investigations and the number of additional penalties imposed on corporates.

Role of technology

Businesses have tried different techniques in the past to comply with the problems due to the number of different rules of origin that they need to comply with to ensure that their goods qualify for preferential duty treatment. Such techniques include creating a single rule enterprise of origin that will comply with all FTAs that are being relied on, etc. However, none of these approaches have been completely satisfactory and have required a certain amount of rigidity to the supply chain that can impact the nimbleness required in modern business.

As businesses use more FTAs for tariff preferences, we have the view that more technology solutions will need to be incorporated to ensure compliance. Manual processes are no longer sufficient due to the increasing number of FTAs as well as the increased complexity of supply chains. Some of the technology solutions include:

- Enterprise Resource Planning software, which centralises data and streamlines information flows in a business to hasten the customs declarations process.

- Global Trade Management software with FTA Management solutions that automate the supplier solicitation, qualification, and certificate management processes, enabling importers and exporters to take advantage of preferential duty programs and save on customs duties and taxes.

- Import and Export Management system software that lowers the risk of noncompliance or overpaying duties as businesses will align their information in a centralised database. Further, it automatically calculates costs and expenses for businesses.

- Global Duty Optimisation software that leverages a network of duty suspension programs to achieve cost savings and generate Return on Investment. The software supports various savings opportunities worldwide including free trade agreements.

Conclusion

As businesses face cost pressures with initiatives to increase supply chain resilience, there is a greater need for businesses to latch onto the numerous benefits offered by FTAs. These benefits need to go beyond tariff concessions to include other areas such as NTMs, trade in services, investments, etc.

However, businesses will also need to focus on beefing up their compliance capabilities and incorporate technology solutions to ensure that FTA ROOs are complied with while satisfying the demands of modern complex supply chains (e.g. regional hubs, just-in-time production, vendor managed inventory, global or regional manufacturing locations, the demand to make procurement changes, etc.). Customs authorities are likely to increase origin verification audits to cope with the pressure of meeting government funding needs.

In conclusion, FTAs hold immense potential for businesses to reduce costs and improve efficiency in their supply chains. However, businesses need to ensure that they have the necessary compliance and technology processes and solutions to withstand government scrutiny in audits.

Read the WTS Global Customs Newsletter here.