In January 2024, a total of 26 jurisdictions had successfully implemented minimum tax regulations, marking a transformative era in corporate taxation. These developments represent a significant shift in global tax practices, compelling multinational enterprises (MNEs) to navigate a novel and intricate framework of regulations.

OECD's Working Paper on the Global Minimum Tax

On January 9, 2024, the Organization for Economic Co-operation and Development (OECD) released a working paper "The Global Minimum Tax and the taxation of MNE profit." This working paper, although not representing the official views of the OECD or its member countries, provides valuable insights into the impact of the Global Minimum Tax (GMT).

The key findings of the working paper are as follows:

- Reduced Profit Shifting: The GMT is estimated to reduce profit shifting by approximately half. This reduction in tax rate differentials is projected to decrease the stock of shifted profit from US$698.4 billion to US$356.4 billion.

- Lower Low-Taxed Profit Worldwide: The implementation of the GMT is expected to significantly reduce low-taxed profit worldwide, thanks to reduced profit shifting and top-up taxation. It is estimated that more than two-thirds of MNE profit taxed below the 15% minimum effective tax rate will decrease. This reduction is observed across all income groups but is particularly concentrated in investment hubs.

- Reduction in Tax-Rate Differentials: Following the implementation of the GMT, tax-rate differentials across jurisdictions are predicted to fall by 50%. This leveling of the playing field aims to create a fairer international tax environment.

- Increased Corporate Income Tax (CIT) Revenues: The GMT is anticipated to boost CIT revenues by an average of US$155 billion to US$192 billion annually. This increase represents between 6.5% to 8.1% of the current global CIT revenues on average.

Implementation of the EU Minimum Tax Directive

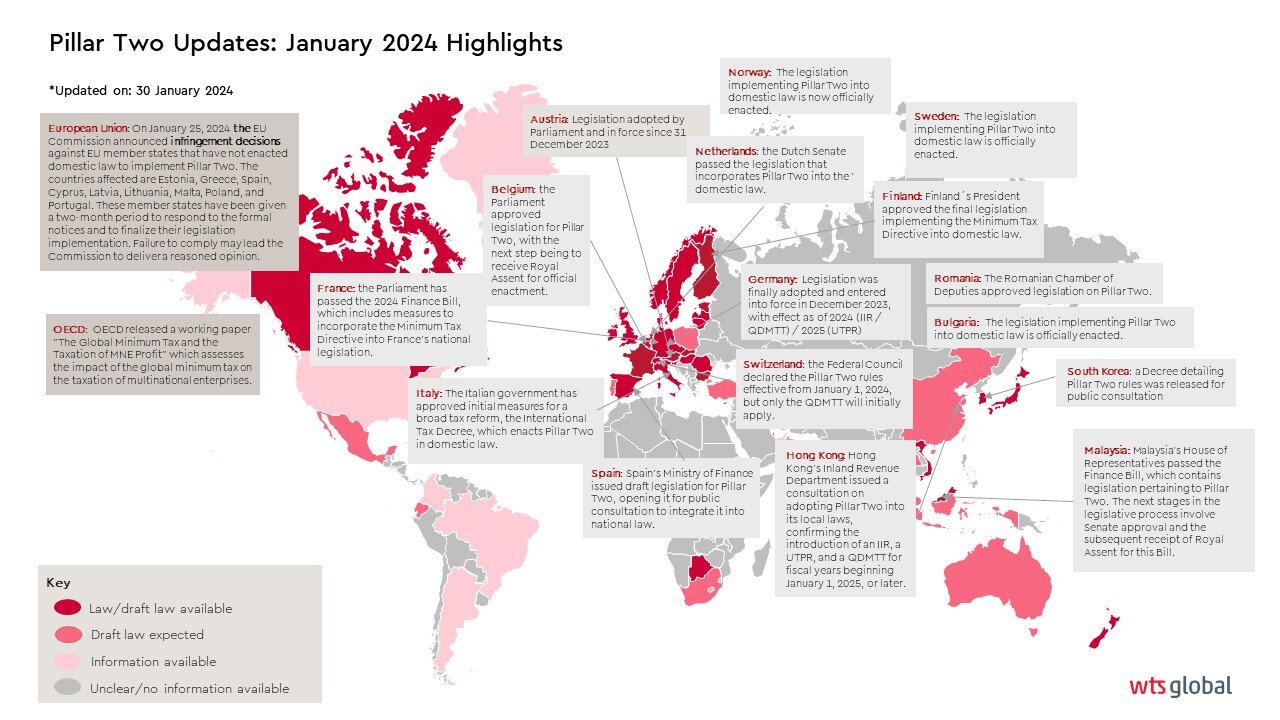

Regarding the implementation of the EU Minimum Tax Directive, as of the end of January, eighteen EU Member States - Austria, Belgium, Bulgaria, Croatia, the Czech Republic, Denmark, Finland, France, Germany, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Romania, Slovakia, Slovenia, and Sweden, had finalized the domestic legislative process required for its enactment.

In line with the EU Directive, the Income Inclusion Rule (IIR) applies in all EU jurisdictions that have enacted related legislation for financial years starting on or after December 31, 2023, except for Slovakia, which has made use of the deferral option. The Undertaxed Payment Rule (UTPR) becomes applicable one year later, i.e., for financial years starting on or after December 31, 2024, except where the Ultimate Parent Entity (UPE) of the group is located in an EU Member State that opted for the IIR and UTPR deferral (Article 50 of the Directive).

All EU jurisdictions that have completed the transposition process will apply a Domestic Minimum Top-up Tax (DMTT) for financial years starting on or after December 31, 2023.

On December 10, 2023, the European Commission issued a Note recognizing that Estonia, Latvia, Lithuania, Malta, and Slovakia have exercised their option under Article 50 of the Minimum Tax Directive. Article 50 of the Minimum Tax Directive permits Member States with fewer than 12 Ultimate Parent Entities (UPEs) falling under the Directive's scope to postpone the implementation of IIR and UTPR for a consecutive six-year period starting from December 31, 2023. However, it emphasizes that these Member States are still required to implement all other provisions outlined in the Minimum Tax Directive to ensure consistent application across jurisdictions and among taxpayers. The Minimum Tax Directive explicitly mandates that other Member States must apply the UTPR to their constituent entities belonging to such groups, effective from December 31, 2023.

As of January 25, 2024, the EU Commission announced infringement decisions against EU member states that have not enacted domestic law to implement Pillar Two: Estonia, Greece, Spain, Cyprus, Latvia, Lithuania, Malta, Poland, and Portugal. These countries have been given a two-month period to respond and finalize their legislation, with potential further action by the Commission if compliance is not met. The EU Commission announced infringement decisions against these Member States, granting them two months to reply to the letters of formal notice and complete their transposition, or face the issuance of reasoned opinions.

On December 22, 2023, the European Commission updated its webpage on the Minimum Tax Directive, adding various documents, including a frequently asked questions (FAQ) document. The Commission clarifies on its webpage that this document reflects the Commission Services' perspectives and is non-binding for both the Commission and the Member States. The FAQ document primarily reiterates that the Guidance of the Inclusive Framework can serve as a source for interpreting and implementing the Pillar Two Directive, ensuring consistency among Member States, provided it aligns with the Directive and Union law.

Additionally, on the same date, the General Court of the Court of Justice of the European Union issued a decision in Case T143/23. This case involved a taxpayer's request for the partial annulment of the Minimum Tax Directive, specifically regarding its impact on the Dutch tonnage tax regime. The applicant contended that the Directive might subject their business to top-up tax and hinder their ability to recover investments made under the tonnage tax scheme. However, the General Court dismissed the case, deeming it inadmissible because the applicant couldn't demonstrate that they belonged to a "limited class of persons" whose pre-existing rights were affected by the adoption of the Minimum Tax Directive.

Other Country-Specific Developments

In addition to these developments, several other countries have taken significant steps related to the implementation of Pillar Two rules:

- Barbados: Unveiled draft legislation for Pillar Two, introducing a Qualified Domestic Minimum Top-up Tax (QDMTT) for fiscal years starting on or after January 1, 2024.

- Gibraltar: Introduced Pillar Two-compliant QDMTT for fiscal years starting on or after December 31, 2023, with full implementation of Pillar Two rules planned after December 31, 2024.

- Hong Kong: The Hong Kong Inland Revenue Department has initiated a consultation regarding the framework of a global minimum tax and the Hong Kong Minimum Top-up Tax (HKMTT). This consultation period remains open until March 20, 2024, with the government planning to introduce legislative amendments in the latter part of 2024.

- Liechtenstein: Officially enacted the Minimum Tax Act to align with the EU Minimum Tax Directive, with the IIR and DMTT becoming applicable from 2024.

- Malaysia: Officially enacted the Finance Act (No. 2) 2023, implementing the Pillar Two GloBE rules in Malaysia effective from 2025.

- Norway: On January 12, 2024, the Norwegian Council of State ratified the enactment of the Supplementary Tax Act by the Norwegian Parliament under Legislative Decision 37 (2023-2024) Act No. 1. Consequently, IIR and DMTT rules are applicable from 2024. UTPR is expected to be legislated at a later stage.

- South Korea: Enacted the 2024 Tax Reform Bill, postponing the UTPR to January 1, 2025. A public consultation on GloBE Model Rules is currently open until March 20, 2024.

- Switzerland: The Swiss Federal Council has officially announced the commencement of the Swiss implementation of Pillar Two rules, effective from January 1, 2024. However, only the QDMTT will be in effect from January 1, 2024. The implementation of the IIR and the UTPR has been deferred and will be reviewed at a later date, with the possibility of enforcement on January 1, 2025.

- United Kingdom: On December 21, 2023, the UK issued comprehensive draft guidance on various aspects of the UK's multinational top-up tax, including guidance on ETR calculations.

- United States: On December 11, 2023, the Treasury Department and IRS released Notice 2023-80, outlining forthcoming proposed regulations that generally restrict U.S. foreign tax credits and deductions for IIRs and specific Domestic Minimum Top-up Taxes, while QDMTTs remain unaffected. Additionally, it clarified that legacy dual-consolidated losses from before 2024 are generally not triggered as they are considered in determining the Net GloBE Income for a jurisdiction.

- Vietnam: Instructed by the Vietnamese government on January 10, 2023, the Ministry of Finance is tasked with issuing a Decree by October 31, 2024, to offer more extensive guidance on the implementation of Pillar Two rules in Vietnam. This directive aligns with Resolution No. 107/2023/QH15 of December 8, 2023, which provides for the implementation of the GloBE rules in Vietnam from January 1, 2024.