08.07.2024

Pillar Two: Updates June 2024

Key Facts

Discover the latest Pillar Two updates and regulatory shifts across multiple jurisdictions.

With representation in over 100 countries, WTS Global provides you the bundled overview of the implementation status of the Pillar Two rules in 72 countries.

Given that such legislative activity is intensifying, it is important to keep abreast of all the latest Pillar Two developments worldwide.

As the international tax landscape continues to evolve, staying informed about the latest developments is crucial for businesses operating across borders. Here's a roundup of significant updates from June 2024 regarding Pillar Two, including insights into regulatory changes, compliance requirements, and implementation progress across various jurisdictions.

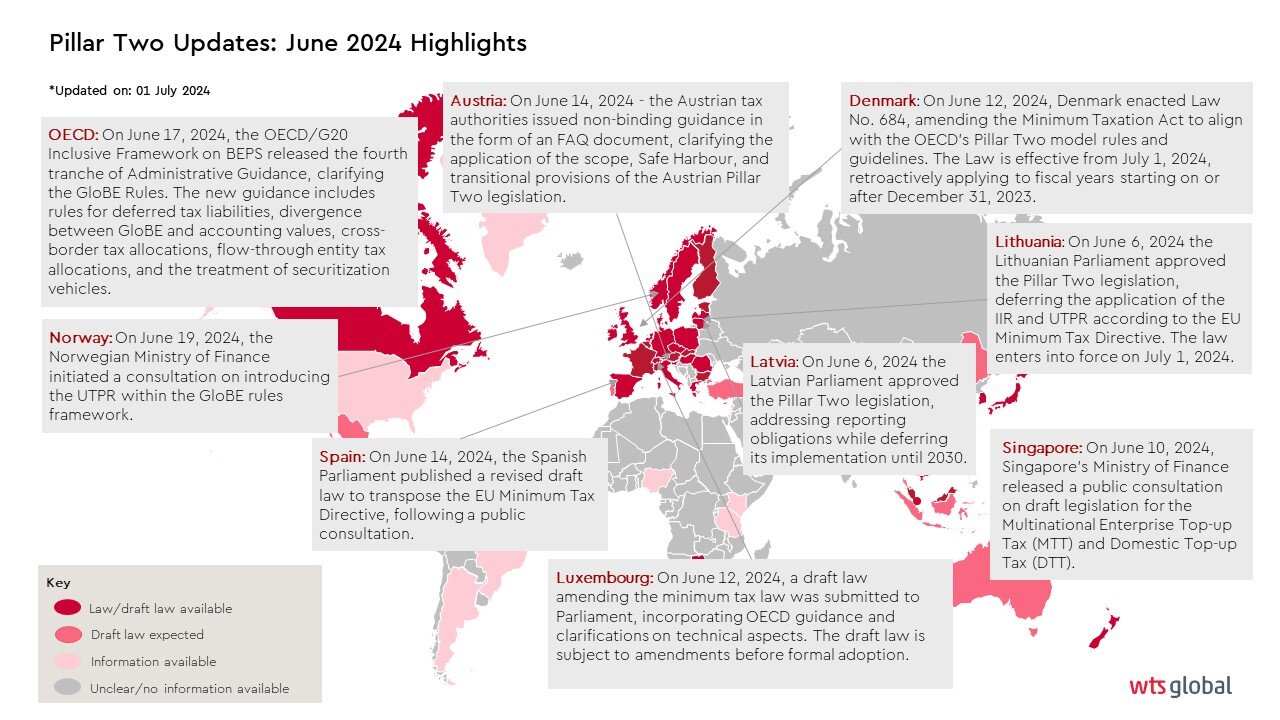

OECD: On June 17, 2024 the OECD/G20 Inclusive Framework on BEPS released the Fourth Set of OECD Administrative Guidance on the implementation of the Global anti-Base Erosion Model Rules ("GloBE Rules"), addressing recapture of deferred tax liabilities, differences in GloBE and accounting carrying values, allocation of current and deferred taxes to PEs and CFCs, allocation of profits and taxes in hybrid situations, and treatment of securitization vehicles. Additionally, the Inclusive Framework released a Q&A document outlining plans for peer review to assess the qualified status of jurisdictions' Income Inclusion Rule ("IIR"), Undertaxed Profits Rule ("UTPR"), and Qualified Domestic Minimum Top-up Tax ("QDMTT"), and their eligibility for the QDMTT Safe Harbor.

Meanwhile, countries worldwide continued their efforts to integrate the OECD's Pillar Two rules into their national legislation. Here's an overview of the latest advancements from May 2024:

-

Austria: On June 14, 2024, the Austrian tax authorities issued non-binding guidance in the form of an FAQ document, clarifying the application of the scope, Safe Harbour, and transitional provisions of the Austrian Pillar Two legislation. The FAQs address the list of countries falling under the Austrian QDMTT Safe Harbour, the application of the UTPR Safe Harbour, disclosure of deferred tax assets and liabilities, and prior-year adjustments.

-

Denmark: On June 12, 2024, Denmark gazetted a bill amending the Minimum Taxation Act and the Tax Assessment Act, implementing elements of the OECD Administrative Guidance and aligning with the EU Minimum Tax Directive. The bill will be effective from July 1, 2024, retroactively applying to fiscal years starting on or after December 31, 2023.

-

Latvia: On June 6, 2024, the Latvian Parliament approved the Pillar Two legislation, addressing reporting obligations while deferring its implementation until 2030. Ultimate Parent Entities in Latvia must designate a foreign reporting entity to handle reporting responsibilities.

-

Lithuania: On June 6, 2024, the Lithuanian Parliament approved the Pillar Two legislation, deferring the application of the IIR and UTPR according to the EU Minimum Tax Directive. The legislation focuses on filing obligations and administrative procedures.

-

Luxembourg: On June 12, 2024, a draft law amending the minimum tax law was submitted to Parliament, incorporating OECD guidance and clarifications on technical aspects. The draft law is subject to amendments before formal adoption.

-

Norway: On June 19, 2024, the Norwegian Ministry of Finance initiated a consultation on introducing the UTPR within the GloBE rules framework. The UTPR would apply to financial years starting after December 31, 2024, with a mechanism to allocate the UTPR among local constituent entities. Responses are expected by September 2, 2024.

-

Singapore: On June 10, 2024, Singapore's Ministry of Finance released a public consultation on draft legislation for the Multinational Enterprise Top-up Tax (MTT) and Domestic Top-up Tax (DTT). The draft legislation aligns with OECD Model Rules, including a DTT intended as a QDMTT. The public consultation is open until July 5, 2024.

-

Spain: On June 14, 2024, the Spanish Parliament published a revised draft law to transpose the EU Minimum Tax Directive, following a public consultation. The draft law may undergo further modifications during the parliamentary process, with a public consultation ending on June 24, 2024.

For a comprehensive overview of developments across 72 jurisdictions, we invite you to read more in our detailed overview. Our team of tax experts worldwide stands ready to provide tailored guidance and assistance specific to your jurisdiction.

Get in contact

If you have any questions about WTS Global or our global services, please get in touch.

We will respond to you as soon as possible.