10.06.2018

China updates “beneficial owner” rules

BEPS-related action to improve the clarity regarding BO assessment and allow more non-abusing cases to enjoy tax treaty benefits

China‘s State Administration of Taxation (“SAT”) has issued Announcement No. 9 (“Rule 9“) to refine its beneficial ownership (“BO”) rules for the implementation of its tax treaties, effective as of 1 April 2018.

This announcement is another BEPS-related action to improve the clarity regarding BO assessment and allow more non-abusing cases to enjoy tax treaty benefits. Rule 9 will apply to all of China’s tax treaty clauses on dividends, interest and royalties.

It was stated in Action 6 of the BEPS project that treaty abuse, particularly treaty shopping, should be identified and curbed, as it undermines tax sovereignty by claiming treaty benefits that are not intended to be granted.

- Rule 9 is the third milestone amendment to BO rules, repealing the last two:Rule 610 (ref. Guo Shui Han [2009] No.601)

- Rule 30 (ref. SAT Announcement [2012] No. 30)

Rule 9 offers clarity on some technical issues and improves BO assessment by introducing changes over seven areas:

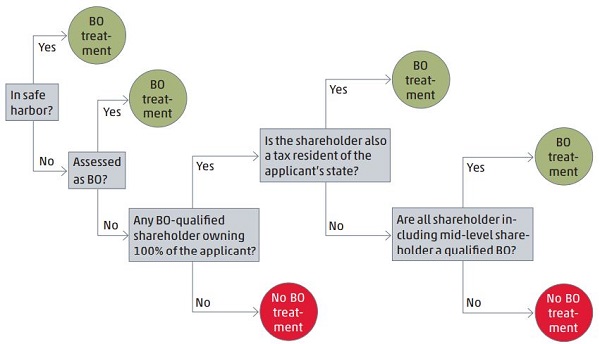

- a) Expanding the safe harbour scope, apart from listed companies, to include governments and individuals as eligible BOs for dividends;

- b) Accepting a non-qualified applicant as a BO for China-sourced dividends, provided that two conditions are met:

- It is 100% owned by a shareholder that meets the BO criteria and also a resident of the same country (region) as the applicant;

- Its shareholder and mid-level holding entities can all meet BO criteria – even if its shareholder is not a resident of the country (region) of the applicant.

- c) Adding a 12-month stock holding condition for applicants 100% held by qualified BOs;

- d) Reducing negative factors from seven to five, which refer to unfavourable factors for assessing a BO status of an applicant:

- If the applicant is obligated to pay 50% or more of the income, within 12 months of receipt of the income, to a resident of a third country (region);

- If the applicant’s operation does not constitute substantive business activities;

- If a treaty counterparty country (region) does not tax or exempts tax on the income, or taxes it at a very low rate;

- If there is another loan agreement between the creditor and a third party bearing a similar value, interest rate and execution date, for China-sourced interests;

- If there is another transfer agreement for IP use rights or ownership between the applicant and a third party, for China-sourced royalty.

- e) Clarifying that collection agents are not BOs;

- f) Clarifying that a residence certificate must be provided for income-related current year (or a previous year); and

- g) Requiring a province-level SAT to be informed on any voluntary disqualification initiated by applicants.

The new BO rules is summarised in the decision tree below:

Rule 9 has drawn on the experience of BEPS to avoid granting treaty benefits in inappropriate circumstances and enhance policy precautions against abuse of tax treaty agreements.

Non-residents, if failing to meet the BO requirements, will lose their tax treaty treatments for dividends, interests or royalty. Therefore, BO definitions are crucial in assessing the eligibility for tax treaty benefits.

Circular 9 brings some good news, but also imposes some stricter requirements. MNCs are advised to re-visit their investment structure and business models and assess how they are affected by Circular 9.

Article published in TP Newsletter #1/2018

Transfer Pricing Newsletter: Update on the recent news and cases

View publication

Newsletter Transfer Pricing

With this newsletter, we inform multinational companies on country-specific and international legislative documents and regulations.

Get in contact

If you have any questions about WTS Global or our global services, please get in touch.

We will respond to you as soon as possible.