14.06.2018

Extension of TP control to permanent establishments in Ukraine

Documented and non-documented transactions are subject to TP control

Since 1 January 2018, the Tax Code of Ukraine was supplemented with provisions that extend transfer pricing control to transactions between non-resident entity and its permanent establishment in Ukraine.

In accordance with Ukrainian legislation, both documented and non-documented transactions are subject to TP control. This means that, although from the civil law point of view, there are no transactions between the PE and the non-resident as such, for TP purposes, “deemed” transactions between the PE and its non-resident should be identified. This approach follows the principle of distinct and separate taxpayer, envisaged by Ukrainian tax legislation, under which the PE for tax purposes is understood as a taxpayer conducting its own business activity separately from the non-resident.

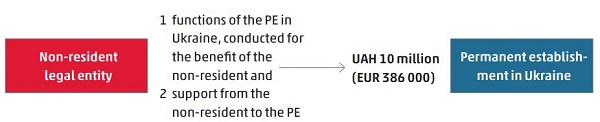

The Tax Code also added a special valuation threshold for the recognition of controlled transactions between PE and non-resident entities: the annual value of such transactions shall exceed UAH 10 million (around EUR 386,000 according to the current exchange rate).

Furthermore, the recent amendments to the TP rules also envisage that the established value threshold shall be calculated not only based on accounting records but considering the arm’s length value of transactions.

For the purposes of TP control, “deemed” transactions between the PE and non-resident may include (1) functions of the PE in Ukraine, conducted for the benefit of the non-resident and (2) support from the non-resident to the PE.

Such functions of the PE and support from the non-resident would be considered “deemed” transactions between the PE and its non-resident for TP purposes, irrespective of whether or not they are documented as a transaction.

Based on the current legislation, we conclude that the transactions between PEs in Ukraine are not yet considered as triggering TP control in Ukraine. Yet, this may change.

In general, the introduction of TP control for PEs in Ukraine triggers necessity for the PEs to comply with Ukrainian TP rules, which means preparing and submitting the Report on Controlled Transactions and preparing the TP Documentation detailing the TP analysis. In the absence of the official guidelines regarding TP analysis for PEs, we tentatively conclude that the authorised OECD approach on the allocation of profits to PEs may be applied.

For the sake of completeness, it should be noted that the current legislation provides for several options for calculating the taxable profit of PEs of non-residents, which are as follows: (1) direct calculation of the PE’s profits and expenses, (2) drafting of separate balance sheet of activities via the PE, which should be agreed by fiscal service, (3) estimation of profit by calculation of 30% of the revenue of the PE.

As of 1 January 2018, the Tax Code also provides that the above calculations of the profits of the PE should be carried out with due regard to TP rules.

However, the existing rules (in addition to the regulations detailing the procedure of profit tax reporting by PEs) are not entirely aligned with the new approach that relies on TP principles and rules. Our conclusion is also confirmed by the representatives of the State Fiscal Service, who have also informed that the changes of these rules are expected.

Newsletter Transfer Pricing

Transfer Pricing Newsletter: Update on the recent news and cases

View publication

Newsletter Transfer Pricing

With this newsletter, we inform multinational companies on country-specific and international legislative documents and regulations.

Get in contact

If you have any questions about WTS Global or our global services, please get in touch.

We will respond to you as soon as possible.