29.11.2018

Ukraine: Transfer pricing in figures

Overview of reported controlled transactions and TP audits since 2013

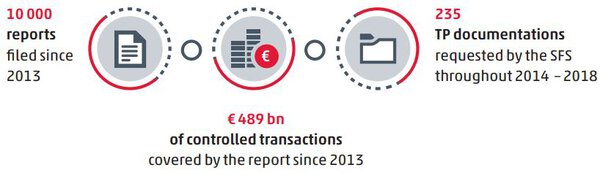

Under Ukrainian legislation, taxpayers engaged in controlled transactions must file reports on controlled transactions (hereinafter “CT”) by October 1 of the year following the reporting year. Taxpayers must also compose and keep annual TP documentation. The State Fiscal Service (hereinafter “the SFS”) may request access to such TP documentation during the process of a TP audit. Below we have provided infographics outlining the main features of controlled transactions reported during the period 2013–2018 and basic results of TP audits, which were published by the SFS on its official website:

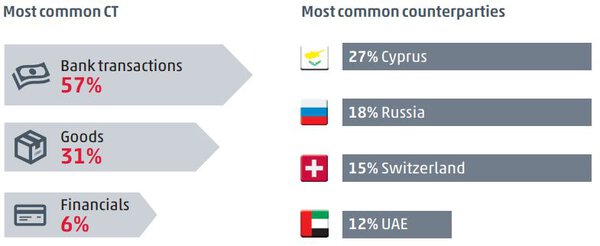

Reported controlled transactions 2013–2018

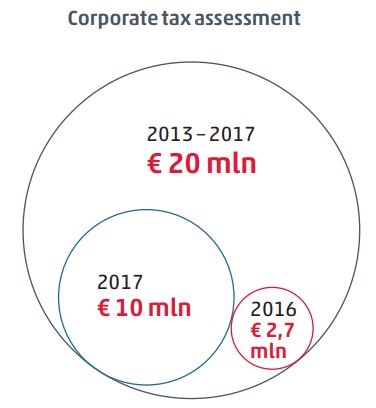

TP audits 2013–2018

In the results from four reporting periods, the SFS established 600 violations of the requirements on reporting deadlines and the completeness of the reports on CT. Therefore, taxpayers were fined EUR 8 million, of which 55% was actually paid to the state budget of Ukraine. In 2015–2018 the SFS started 58 TP audits, 34 of which have already been completed, resulting in the corporate profit tax assessments presented in the graph here. 430 taxpayers performed self-adjustments of transfer prices and increased their taxable income or reduced losses from controlled transactions in 2013–2016 by a value greater than EUR 443 million.

Article published in TP Newsletter #2/2018

Transfer Pricing Newsletter: Update on the recent news and cases

View publication

Newsletter Transfer Pricing

With this newsletter, we inform multinational companies on country-specific and international legislative documents and regulations.

Get in contact

If you have any questions about WTS Global or our global services, please get in touch.

We will respond to you as soon as possible.